[F12] Recursos - Tips para ahorrar para la jubilación: cuándo y cómo empezar

When should I start saving up for my retirement?

Tips for saving for retirement: when and how to get started

Every recipe has ingredients that are vital to success, but time and effort are always the best way to ensure a tasty dish. Proof of this is that older people tend to be great cooks as they have been making the same recipes for years. In financial matters, like saving, broadly speaking, there are no secret tricks or formulas, you just need time and perseverance.

Even so, you might need a gentle nudge to start saving for retirement and it is normal to wonder how and when to do that. At VidaCaixa we explain how, by saving €50 a month now, you can save for your retirement. Every cent counts when it comes to creating the extra income that will become the perfect financial cushion for a relaxing future. Get started straight away!

When and how should I start saving for my retirement?

Building a nest egg for your future is crucial and doing this as soon as possible, in a constant, systematic way, is essential to have a good pension pot. Time and perseverance are your allies in boosting your pension but, what steps do you need to take to start saving for retirement?.

There is no specific age when you should start saving for your retirement. However, there is a maximum age accepted and recommended by advisors, although the sooner you start the better, because it will require far less effort. You should start as soon as you have some capacity for saving. The assumption is that from the age of 30 onwards is an ideal time to start, or even earlier if possible.

We can give you some tips for saving for your retirement, but the most important advice is to be conscious and consistent. To start with, calculate your income and fixed expenses, and from that you can work out how much you can save approximately. Your expenses may be variable, but this can help you if it allows you to reduce them and save more.

Saving through pension schemes allows you to generate savings to supplement your retirement pension, and you will also benefit from significant tax advantages. Other options are savings insurance policies, such as CaixaFuturo, which you can use to save systematically, almost without realising it. You can access your savings at any time. However, if you are looking for an easy way to start saving for your retirement, Valor Futuro 10 Unit Linked, is a good option allowing you to be consistent and start planning your retirement savings.

How much to save per month: find out what you can get in your retirement with €50

Over 50% of Spanish residents have no savings whatsoever to supplement their retirement pension. A report published by the Spanish Association of Insurers, Unespa, indicates that in little more than a decade the number of people who have taken out some kind of pension scheme or insurance for their retirement has fallen considerably.

HYPOTHETICAL CASE OF SAVING FOR RETIREMENT

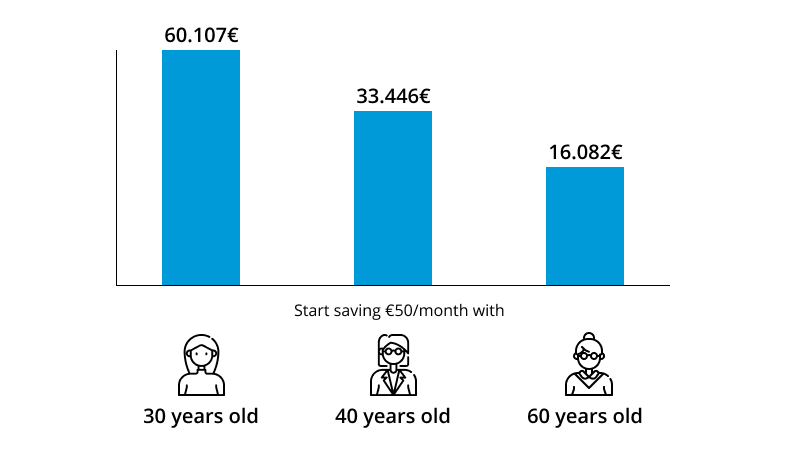

Discover what you can get for your retirement with €50 a month. This is a hypothetical case of a pension scheme that will yield an estimated average return of 3.4% with contributions increasing by 2% every year. The final savings are calculated for a retirement age of 67.

Let’s suppose that Patricia decides to save €50 a month for her future. Since she is young, making this minimum effort can lead to great results. That saving adds up to €600 a year. Assuming no additional gains from that money, on the day of her retirement she would have approximately €22,200 in her account. Imagine what Patricia could do with a retirement savings scheme.

Let’s assume that each year she has achieved an average return of 3.4% on her pension scheme, and that she has also increased her savings contribution by 2% each year. This would mean that, when she reaches the age of 67, her savings would amount to around €60,100.

So you see, there are no tricks to saving other than starting as soon as possible. This is the only secret to improving your retirement. Remember that your savings can work for you and that’s why perseverance is essential to achieve your goal.

Our example shows how you can see your money grow by contributing only €50 a month. This will give you a more than adequate and interesting nest egg to help deal with whatever the future brings. In case you are wondering, €50 is enough to turn your monthly saving into a healthy addition to your pension.

Categorías relacionadas - titulo

Categorías relacionadas - carrusel - planes de pensiones - Unit Linked - CaixaFuturo

[TEXTO SEO]- PREGUNTAS FRECUENTES

Asset Publisher

-

How much do people usually save each month?

-

The amount you save will depend on how much you earn. If you earn €800 per month, you can save at least 10%, which is a minimum of €80 per month, but if you wish, you can save as much as 40%. If you earn over €1,200, you can save between 15% and 45% of your income. Therefore, while it all depends on your situation and your fixed expenses, you can stretch your income more or less.

-

-

How much should I save every month for my retirement?

-

There is no specific amount you should save, but we do advise you to put aside at least 10% of your monthly salary and increase this as your salary rises over time.

-

-

What should I do to have a good pension pot?

-

People often ask themselves what they should do to have a good pension pot, but there is no specific guide for this. What you really need is the help of an expert advisor or to draw up a plan with a pension scheme early on.

We advise you to start early. How can you prepare for retirement? Some tips include first thinking about how you would like to live when you retire. Estimate how much pension you will receive from the government, taking into account important factors like inflation and your return or risk profile. Look into pension schemes and sign up for the one that best fits your needs. Persevere and be patient so that you avoid dipping into the nest egg you are building for your retirement.

-

-

How long do I need to contribute to the Social Security system to get a 100% pension?

-

The retirement age depends on the age of the interested person and the contributions accumulated throughout their working life. The retirement age in Spain is gradually increasing until 2027, when it will be set at 67 years. In 2025, it is 66 years and eight months if one wants to receive 100% of the pension and has contributed less than 38 years and 3 months.

-

-

How can I get the best pension possible?

-

Firstly, you have to take into account your age, savings and income. We advise considering all the key factors involved in getting the best pension possible.

Age is a determining factor in you receiving your retirement pension, based on the number of years you have been contributing to the Social Security system and the increased minimum retirement age. As you know, the higher life expectancy has also meant an increase in the number of years you will be receiving that pension.

Also, putting some money aside every month, as if it were an essential fixed expense, is essential to building a nest egg that will add to your pension. With time and perseverance, you will be able to make those savings work for you and get the best return possible.

-

-

What’s the 50-30-20 rule?

-

This is a basic savings rule to divide your net monthly income into three types of expenditure: 50% to cover your needs, 30% for treats and 20% for savings. This way you can easily calculate how much you spend, see where you have overspent each month and where you can improve. It is very useful, especially to learn good habits, avoid squandering money and always have some savings for unexpected events.

-

-

How much do people save on average in Spain?

-

Savings in Spain have changed with developments in the country’s social situation. The pandemic was a turning point in terms of savings and families save nearly 12% of what they earn, according to the Spanish Statistics Institute (INE). This is the highest rate ever and double than seen before the pandemic. So uncertainty has led people to save up, improving Spanish people’s habits.

-

VidaCaixa Form

Subscribe to our newsletter

You will learn to enjoy the future without worries.