SELF-EMPLOYED

Preferred Pension Plans for Self-Employed in the Basque Country

Discover the first GeroCaixa Pyme plans, created to give you tax advantages, flexibility and

returns tailored to your profile.

corporativo.cookie.title

VidaCaixa uses proprietary and third-party cookies to analyse your browsing for statistical purposes, customisation (ej. video volume) and to show you customised advertising from a profile developed based on your browsing (e.g. clicks on content).

Click for MORE INFORMATION or TO CONFIGURE OR REJECT YOUR USE. You can also accept all cookies by pressing the "Accept and continue browsing" button.

VidacaixaCorporativoBuscadorHeader

Asset Publisher

Asset Publisher

[F8]autonomos - cabecera

SELF-EMPLOYED

Discover the first GeroCaixa Pyme plans, created to give you tax advantages, flexibility and

returns tailored to your profile.

Autónomos - EPSV ATA - Planes de previsión preferente

At GeroCaixa Pyme, we have launched the first occupational pension plans designed

exclusively for the self-employed and their employees. We understand that you are the driving

force behind your business, which is why we have developed a solution that offers protection,

good returns and peace of mind for your future.

With excellent tax conditions, reduced fees and new payment methods adapted to you, our

plans help you build a strong retirement without neglecting your present.

Discover the new Occupational Pension Plans and start looking after yourself the way you look

after your business.

Beneficios EPSV ATA

With the new Occupational Pension Plans for the self-employed, you can benefit from a new tax relief allowance of up to €4,000 per year. This is on top of the €5,000 you can already deduct through your individual plans.

Make regular or one-off contributions, whatever works best with your cash flow.

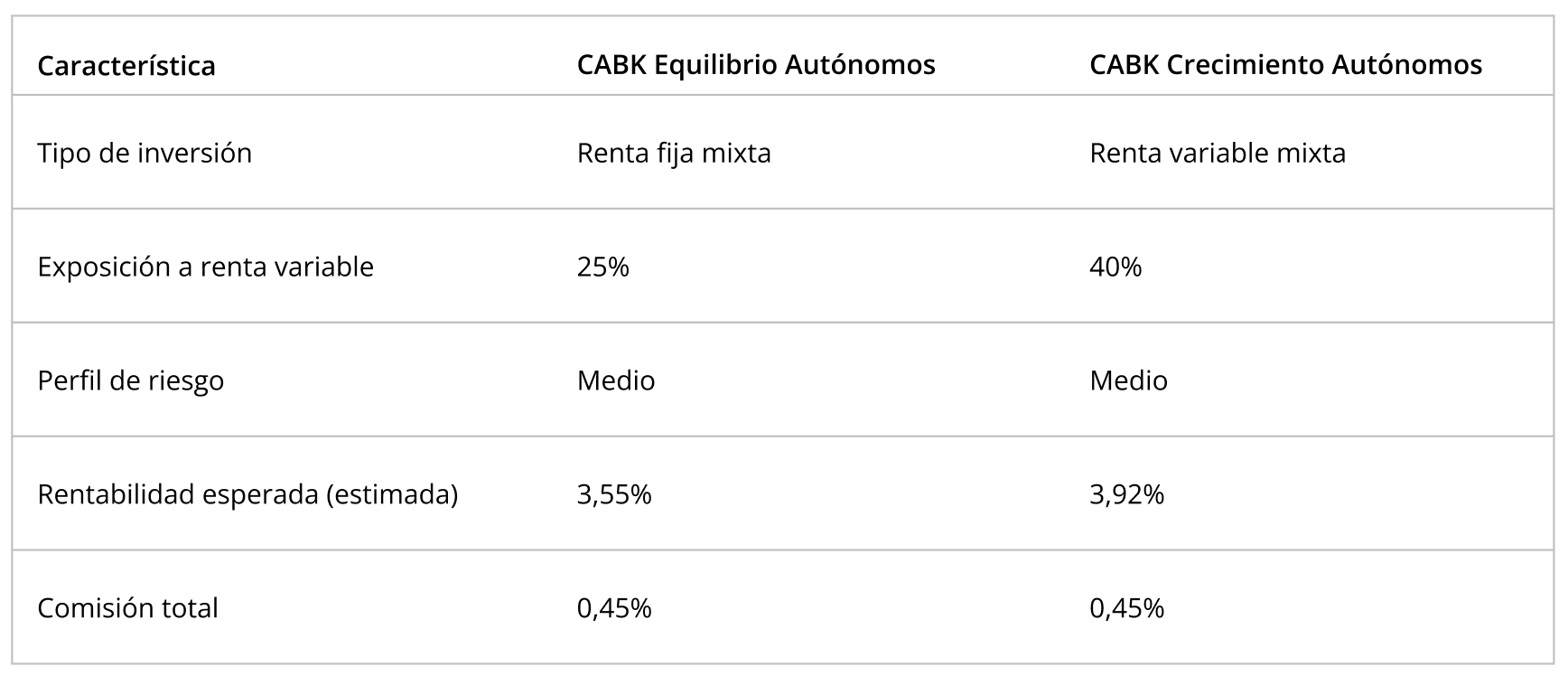

With lower fees than individual plans (just 0.45%), your money works harder for you, in plans tailored to your profile. CABK Equilibrio Autónomos: conservative profile, mixed fixed income (25% equity). CABK Crecimiento Autónomos: dynamic profile, mixed equity (40% equity)

Autónomos - EPSV ATA - Planes que te respaldan cuando lo necesitas

SELF-EMPLOYED

Being self-employed should not mean being on your own. GeroCaixa Pyme’s Occupational Pension Plans are there to support you at every stage of your professional and personal life, offering a safety net when you need it most.

- Peace of mind for the future: Comprehensive pension cover so you can look forward to the future with the security you deserve.

- Support in difficult times: If you face permanent disability, serious illness or long-term unemployment, the plan is there for you. ️

- Protection for your family: In the event of death or dependency, your loved ones will be taken care of.

- Support for your team too: Do you have employees? You can include them in the plan and offer them the same preferential protection.

Autónomos - EPSV ATA - Cobrar prestación

Financial annuity (minimum 15 years) or lifetime annuity.

Lump sum if the amount is below €39,466*.

Mixed: combine annuity and lump sum to suit your needs.

Selected by the Basque Government and Chambers of Commerce as one of six approved providers of Occupational Pension Plans (known in Spain as “Planes Preferential EPSV”).

Part of GeroCaixa Pyme, EPSV de Empleo with institutional backing.

Guaranteed transparency: Supervisory Committee includes self-employed representatives.

Autónomos - EPSV ATA - Leyenda Cómo cobrar tu prestación

Autónomos - EPSV ATA - Comparativa de los planes CABK

Autónomos - EPSV ATA - Tabla Comparativa de los planes CABK

Autónomos - EPSV ATA - Empieza hoy a construir tu jubilación

SELF-EMPLOYED

Autónomos - EPSV ATA - Título FAQs

Asset Publisher

These are pension plans specifically designed for self-employed workers in the Basque

Country. They offer tax benefits, reduced fees and comprehensive cover for a range of events.

Both have a medium risk profile and are designed to suit different saving styles.

Any self-employed person in the Basque Country, as well as their employees if they choose to

include them.

The plans include cover for:

You can contribute:

Yes. You can transfer your rights from other plans, even if they are not Occupational Pension

Plans.

However, you may only transfer your rights into other Occupational Pension Plans.

Only when one of the covered events occurs.

Withdrawals based on plan duration alone are not permitted.

Both plans have a total fee of just 0.45%, helping to maximise your net return.

You become a suspended member but retain your financial rights, which you can later

reactivate or transfer to another Occupational Pension Plan.

Each plan has a Supervisory Committee with representation from the Chambers of Commerce

and the self-employed, ensuring transparency and oversight.

[Texto SEO] Atencion al cliente - preguntas frecuentes CTA

Autónomos - EPSV ATA - Categorías relacionadas

Categorias relacionadas Particulares

Asset Publisher

VidacaixaForm New

You will learn to enjoy the future without worries.