Key needs and opportunities

With life expectancy potentially exceeding 90 years for those born in Spain today, relying

solely on a state pension is no longer enough to guarantee wellbeing.

Financial planning

An increasing number of people are combining their pension with lifetime annuities, investment funds, pension plans and other savings and investment solutions that provide extra liquidity. According to the Bank of Spain (2024), more than 35% of today’s retirees already supplement their pension with additional income.

In Spain, more than three in four people over 65 own their home (INE, 2024). Unlocking that equity without leaving the home is key for many families: options such as reverse mortgages, selling the bare ownership, or advance rental agreements can convert property into income, strengthening financial security while staying in the family home.

Dependency and care

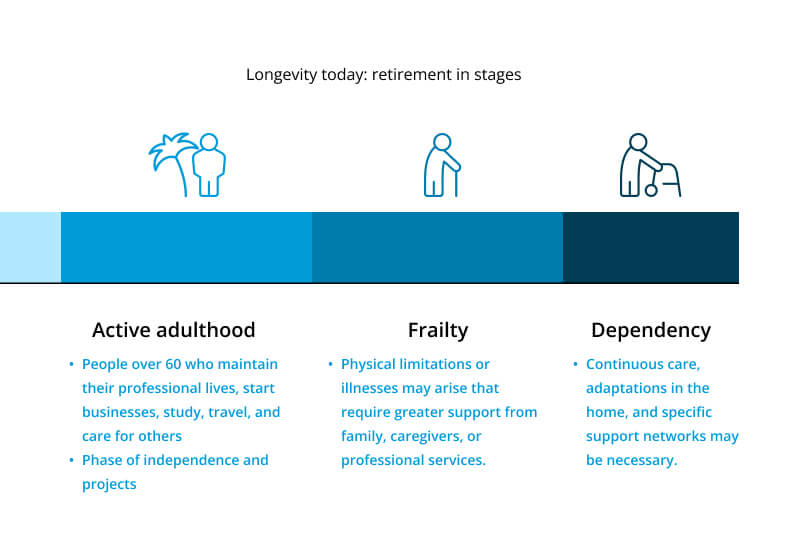

Living longer increases the likelihood of needing help with daily tasks or specialist care. Planning ahead for costs associated with dependency — care homes, carers, teleassistance or home adaptations — helps families make calm, informed decisions and avoid unforeseen strain in vulnerable moments. According to IMSERSO, 20% of people over 80 require continuous assistance.

Employment and training for the over-60s

Extending working life, when desired, not only adds income but keeps knowledge and social networks active. Japan and Germany already run well-established continuous learning and retraining programmes for people over 60. In Spain, incentives for voluntarily extending careers and senior training are developing, but there’s still ground to cover to match our European neighbours (Eurofound, 2024).

Planning for peace of mind: foresight and protection

Anticipating future needs is the best way to gain peace of mind. Longer lives require clear strategies to diversify income, protect the home, plan for dependency and organise inheritance. This is where Generación +, CaixaBank’s initiative, comes into its own, supporting every stage of this new longevity with:

- Tailored protection and liquidity: products such as lifetime annuities, investment funds, reverse mortgages or sale of bare ownership.

- Comprehensive support: solutions for managing dependency, professional care services and specialised human advice.

- Knowledge and foresight: a pioneering research lab, in partnership with ESADE, Comillas and Deusto, that listens to the senior generation to design living solutions aligned with their real needs.

A new perspective: experience, empathy and less ageism

A long-lived society needs to break down prejudices and overcome age barriers. The accumulated experience of the senior generation is a value that enriches society as a whole: it contributes time, intergenerational care, volunteering, mentoring and community involvement. Championing less ageism and more empathy paves the way for more human models, accessible housing, neighbourhood support networks, flexible employment and living arrangements adapted to different life stages.

In conclusion

The question is no longer whether there will be pensions when we retire, but how we want to live each stage of our lives. The senior generation rejects one-size-fits-all answers: it demands choice, information and the confidence to decide without fear.

With more than four million clients aged 65 or over, VidaCaixa wants to be there for them, adapting to new realities with new solutions. We are the company for the senior generation, working to ensure their wellbeing and meet their needs.

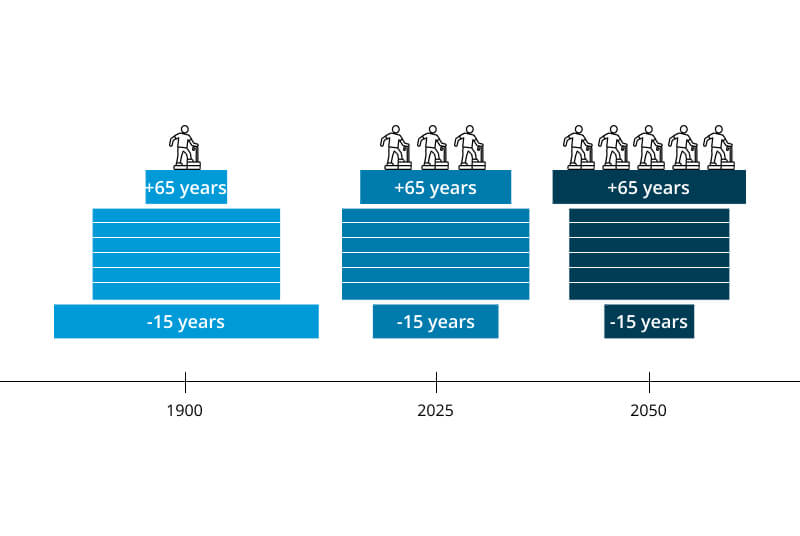

Planning today is the best way to decide tomorrow. And when the pyramid changes, you have a plan that changes with you.