VidacaixaCorporativoBuscadorHeader

[F12] Recursos - Simulación de jubilación

¿Estoy a tiempo de tener una buena jubilación?

Retirement simulation: The five basic questions (you should ask yourself) to have a good retirement

A good retirement is possible if you plan for it and start thinking about it now, because when it comes to building up a nice financial cushion for your retirement, we so often start too late. The earlier you start the better. When it comes to planning your retirement, we recommend following a series of steps by answering key questions that help you understand what you want in your retirement.

You can simulate your retirement by adopting a reflective mindset and building your future based on what you know about your life now. How? The first step is personal reflection, trying to imagine, realistically, the future you really want.

Here you should think about what kind of retirement you want to have, what you are going to spend your time doing and at what age you would like to retire. After that, foresight and planning come into play and it is time to define the roadmap, decisions and steps to take in order to achieve your goals. Here you will need to estimate what income you will have when you retire, what savings you will have built up and what savings you might have in a pension scheme.

Retirement calculator, start thinking about your future

These steps are essential in order to simulate your retirement. With our online retirement simulator you can calculate your pension and understand your savings options or the pension schemes that best suit you. Thanks to this simulation, you will be able to visualise the whole process that we recommend in order to have a good retirement. As well as the simulator, at VidaCaixa we share with you the five basic questions you should ask yourself to have a good retirement:

1. Am I still in time to have a good retirement?

It is only natural to ask if you are still in time to have a good retirement. If you want to know how much you need to save now to have a good retirement in the future, it is important to have an estimate of your state pension and, depending on that, together with an estimate of your needs during retirement, you can set your savings target for your retirement. Start saving now to improve your future. That’s the key to being in time to prepare for a good retirement.

2. How much money will you need when you retire?

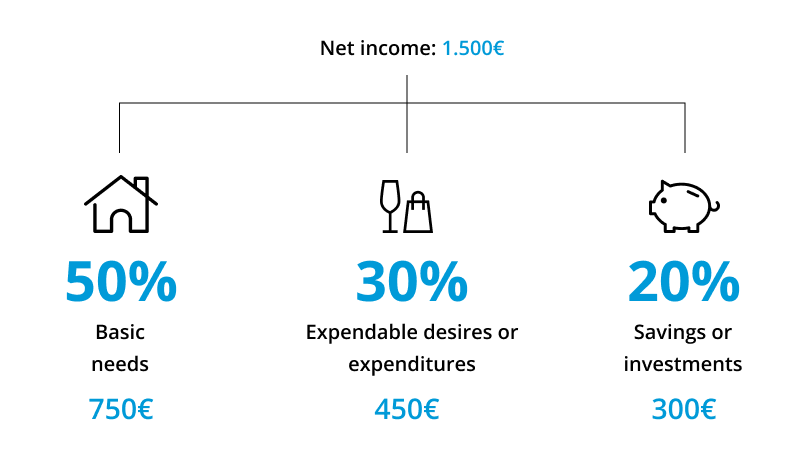

If you would like to simulate your retirement first think about your most basic and regular needs during your retirement. How much money do you think you will need when you retire? You can make an estimate by dividing your monthly expenses into basic needs, housing, leisure, health and money to loved ones. This will give you an idea of the most regular or fixed expenses that will remain during your retirement. Here’s an example:

3. How much pension will you receive?

The retirement pension will be 82% of your final salary. This is according to the OECD (Organisation for Economic Co-operation and Development) in Spain. In other words, this rate is called the replacement ratio, which is on average 71% in Europe and 63% in OECD countries. The long-term forecast, according to the European Commission (EC), is that this percentage will fall to 40%, which means that we will lose 60% of our purchasing power once we retire. To avoid this loss of purchasing power, you have the option of taking out a pension scheme to guarantee your standard of living.

4. How much should you save for your retirement?

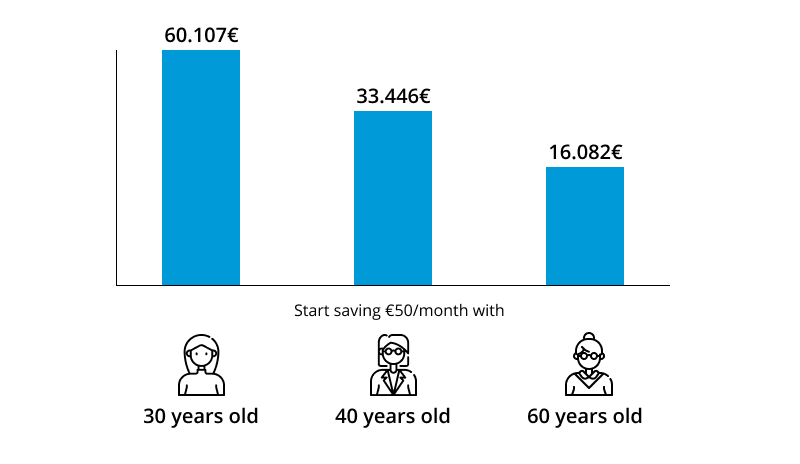

Another issue to think about is your ability to save. If you are wondering how much you should save to improve your retirement, we advise you to simulate your retirement on the Social Security website and be aware of your situation based on your age and circumstances. This will give you an estimate of how much you should save every month to reach your goals or expectations. Here are a few real examples:

5. How can you save?

The best way to save is by being systematic. By getting into the habit of saving and with time on your side, it will take less effort to reach your goal. There are different ways to save for the future. At VidaCaixa we have different savings solutions for your future, for example, pension schemes or Unit Linked savings insurance.

Título SEO - Te ayudamos a elegir tu plan de pensiones

Te ayudamos Plan de Pensiones

Categorías relacionadas - titulo

RELATED CATEGORIES

Categorías relacionadas - carrusel - planes de pensiones - EPSV de particulares - seguros de ahorro Unit Linked

VidacaixaForm New

Subscribe to our newsletter

You will learn to enjoy the future without worries.