VidacaixaCorporativoBuscadorHeader

[F12] Recursos - Descubre cuántos años cotizados necesitas para la jubilación

How many years do I have to work before I can receive my pension?

Discover how many years you need to contribute to your retirement pension

Would you like to know how many years you have to work to receive a full pension? The legislation has been changing in recent years, so it is normal for people who are considering their future retirement to have questions and concerns.

We know retiring from work is a very important chapter and understanding how many years of work you need for a pension is essential. Imagine a retirement without financial worries, where every year worked contributes to a more comfortable life. The secret to an uncomplicated retirement lies in saving, optimising your financial planning to ensure a rewarding and care-free retirement. To do this, you first need to be clear about how many years of contributions you need for a pension.

Calculate how many years you have to work to draw your pension

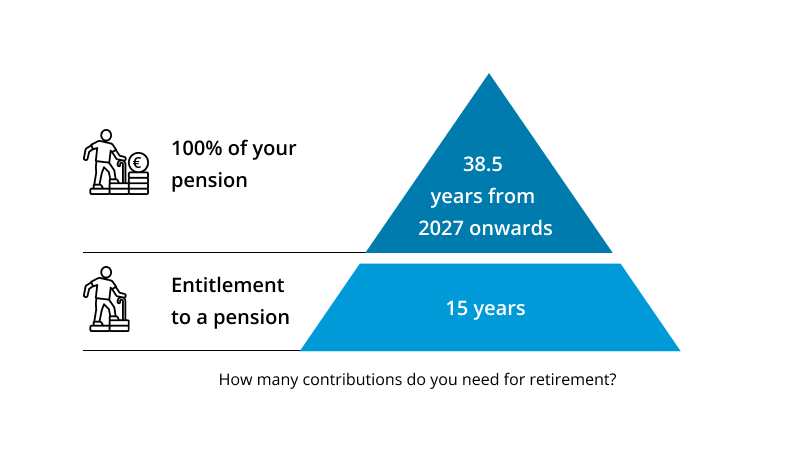

There are two determining factors in drawing a 100% pension. To qualify, you must have reached the legal retirement age or have paid the minimum contributions required by law.

In order to retire and draw any pension, you need to have paid at least 15 years into the Social Security system, two of which must be the two years leading up to the date on which you claim your pension. In other words, you will be entitled to retire as soon as you meet these requirements, but you will only get 50% of the pension.

You have two options to receive 100% of your retirement pension: you can either reach normal retirement age, which will be 66 years and eight months in 2025, or you can claim it at the age of 65 if you have at least 38 years and three months of contributions.

These amounts have been increasing year after year since the pension reform that was approved in 2011 came into force in 2013. The ordinary retirement age in Spain will increase by two months every year until it becomes fixed in 2027.

Until then, it will increase gradually and, at the same time, the number of years of contributions required for a pension benefit will also increase. Thus, to benefit from 100% of your state pension, you will have to reach the age of 67 (or 65 if by then you have made 38 years and six months of contributions or more).

What is the minimum amount of contributions required to claim a retirement benefit?

Now that we have seen how old you have to be to retire, as well as the number of years you have to contribute to claim a 100% pension, let’s look at the minimum number of years you have to have contributed to qualify for any retirement benefit.

To be able to claim a retirement benefit, you need to prove that you have made at least 15 years of contributions to the Social Security system. Once you reach this minimum number of years of contributions, you can claim 50% of your pension benefit.

This percentage increases by 0.19% for each additional month of contributions during months 1 and 248, and by 0.18% for the months exceeding month 248. In no case can the percentage of the regulatory base be higher than 100%, except when the pension is paid at an age higher than the normal age.

The retirement table by year of birth

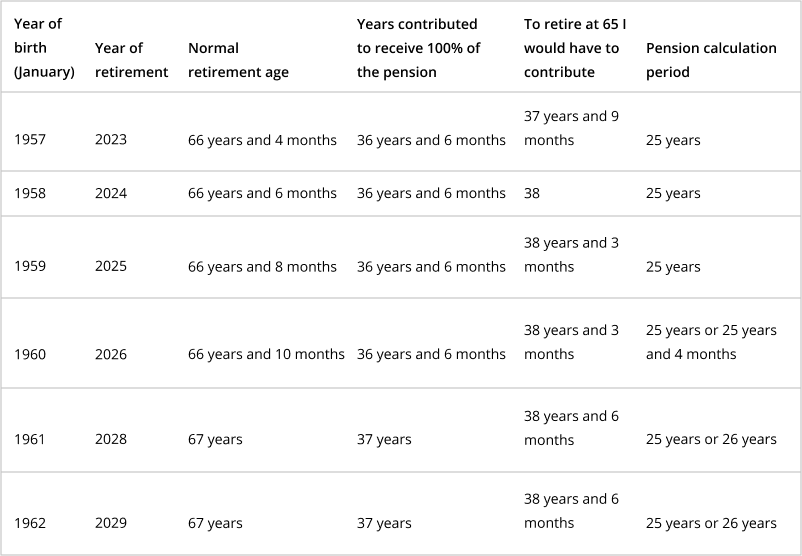

With the implementation of the reform in 2013, both the retirement age and the number of years of contribution have gradually increased. Between 2013 and 2018, the retirement age increased by only one month each year. However, since 2018, this has accelerated to an increase of 2 months for each year elapsed, reaching 67 years in 2027.

As mentioned above, the legal retirement age is currently 66 years and six months, but it will gradually increase to 67 in 2027. In 2026, the new system for calculating the pension will start to be implemented gradually. Let’s take a look at the retirement table by year of birth:

The challenge posed by the baby boomer generation

The mass retirement of baby boomers in Spain, representing around 30% of the population, poses significant challenges for the pension system and the economy in general. The CaixaBank Research study highlights the importance of saving for this generation and those to come, as they are expected to live longer in retirement than previous generations. The phenomenon, which will be felt over the next 20 years, will affect the current pay-as-you-go system, where active workers fund pensions.

Título SEO - Te ayudamos a elegir tu plan de pensiones

Te ayudamos Plan de Pensiones

Categorías relacionadas - titulo

RELATED CATEGORIES

Categorías relacionadas - carrusel - planes de pensiones - EPSV de particulares - seguros de ahorro

[TEXTO SEO]- PREGUNTAS FRECUENTES

Asset Publisher

-

How do I know if I’m entitled to a pension?

-

In order to be eligible for a pension, you must have paid contributions to the Social Security institution and have been working for the minimum time set to receive a pension. You can ask for this information online, through the Social Security website.

-

-

How to get the best pension possible?

-

Firstly, you have to take into account your age, savings and income. We advise you to bear in mind all the keys to getting the best pension possible. Age is a determining factor in receiving your retirement pension, based on the number of years you’ve been paying contributions to the Social Security institution and the increased minimum age. As we know, the higher life expectancy has also meant an increase in the number of years you will be receiving said pension. Also, putting some money aside every month, as if it were a fixed expense, will be essential to build a nest egg that will add to your pension. With time and perseverance, you’ll be able to make those savings work for you and get the best return possible.

-

-

How can I retire at 55?

-

Generally speaking, you can’t retire at 55, as you need to reach the minimum age to be entitled to a forced retirement pension, which is four years before the legal retirement age.

-

-

When should I start saving up for my retirement?

-

There isn’t a specific age to start saving up for your retirement. But there is a maximum age accepted and recommended by any advisor: the sooner you start, the better, because it will require far less effort. Therefore, as soon as you have some savings capacity, like for example at 30, you should start saving up or even before if possible.

-

-

How much should I save every month for my retirement?

-

There isn’t a specific amount to save, but we do advise you to put aside at least 10% of your monthly salary and go increasing it as your salary rises over time.

-

-

What should I do to have a good pension pot?

-

People often ask themselves what to do to have a good pension pot, but there isn’t a specific guide for this. What you really need is the help of an expert advisor or to draw up a plan with a pension scheme early on. We advise you to get going early on. So how do you prepare for your retirement? Some tips are first thinking about how you'd like to live when you retire. Estimate how much pension you’ll receive from the government, taking into account important factors like inflation and your return or risk profile. Look into pension schemes and set up the one that best fits your needs and persevere and be patient to avoid touching the nest egg you’re building for your retirement.

-

-

How long do I need to contribute to the Social Security institution to get 100% of my pension?

-

It depends on how old you are when you retire and the contributions made to the Social Security system during your working life. The retirement age in Spain will increase gradually until 2027, when it will be 67 years. In 2025, the retirement age is 66 years and 8 months if you want to receive 100% of your pension.

-

-

What will happen if I become unemployed or my business closes down?

-

There’s the option of paying the contributions yourself through special agreements with the Social Security authorities to keep being entitled to your pension. Ask one of our advisors or staff members.

-

-

How is the widow/widower’s pension stipulated?

-

The deceased must have been registered with the Social Security institution and paying contributions to it for a certain time. The calculation basis depends on the deceased’s situation (active worker or pensioner) and the cause of their death (common contingency or workplace contingency). Feel free to ask for advice.

-

VidacaixaForm New

Subscribe to our newsletter

You will learn to enjoy the future without worries.